Fixing and flipping a property can bring you an enormous amount of ROI. In 2022, over 300,000 houses were flipped, which indicates that this trend is super popular and effective, but only if done right. However, for that to transpire, you need to find the right financing method to get your hands on the property and make the right repairs.

Due to the intense nature of real estate businesses and changing trends, investors have to find a way to remain on top, get the right funding, and reap the rewards of successfully flipping property.

If you need a little help expanding your fixing and flipping strategy, take a look below as we go over some of the most intelligent financing methods you can use and gain an advantage over the competition.

Do Your Research

It’s not an exaggeration to say that we live in an age of opportunity. Doing just a bit of research will reveal to you that there are numerous fix-and-flip loan opportunities that will ensure you get the best deal with the most favorable terms and rates.

However, all fix-and-flip loans are different and range in size. For instance, you have federally guaranteed rehab loans, also known as 203(k), that can be used to pay for labor and materials related to the purchase and rehabilitation of fixer-uppers.

There are also hard money loans, as well as bridge and conventional loans. Hard money loans are secured by providing the lender with some sort of collateral. The point is that each loan is different, and some can appeal more than others to you, depending on your current situation.

Deciding Which Loan You Need

It can feel overwhelming to settle for a loan that will enable you to earn a lot of ROI. But don’t fret, we are here to help you out.

230(k) Loan

This loan type enables borrowers to finance labor costs that come with the purchase of fixing a property. Bear in mind that these loans are designed for residential properties, and if your sole intent is to fix and flip this type of property, they might just be the perfect option for you.

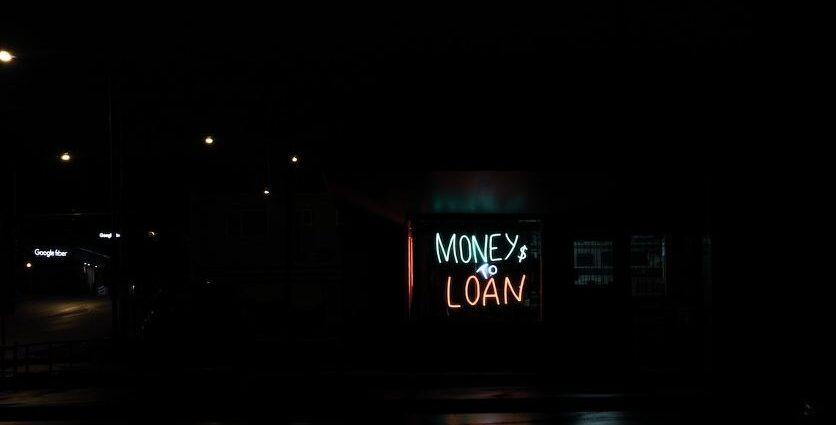

Hard Money Loans

Hard money loans are nontraditional types of loans that are secured by valuable collateral. In other words, they cannot be obtained if you cannot match the borrowed sum with a piece of property or another type of asset that serves as collateral.

The biggest advantage of getting a hard money loan is that the entire process will be much faster than with any other form of loan.

Conventional Loans

Issued by banks, conventional loans can be used to finance a fix-and-flip property, but they can be quite difficult to obtain. You will have to adhere to a lot of stipulations and on top of that, provide the bank with loads of data such as credit score, business plan, and so much more.

The review process can take a lot of time, and you might even miss out on the property while you are waiting for the loan to be approved.

Review The Loans Policies and Intrest Rate

When looking for the best loan for your needs, you need to not only compare interest rates but also consider the various other policies and terms of the loan. While finding savings on interest can improve your financial position, certain policies could make a bigger difference in the long term.

Take some time to go over the details of various banks and lenders, especially noting things like minimum payment requirements or any fees associated with early repayment. It is up to you to find the best option that helps you reach your goals without compromising too much on quality. Plus, shopping around for the best loan option is incredibly simple. Everything is available online, and you can even apply for a loan from the comfort of your home.

Bottom Line

Above, we covered some of the most common loan types for fixing and flipping properties. If you are interested in funding your fix and flip investments the right way, take a look above and determine which loan type is the right one for you.

Remember that certain lenders will offer different policies and those policies will carry specific interest rates. Some might be appealing, while others will not. So, carefully do your due diligence and ensure that you are not making a single mistake during this process.