Main Story

Trending Story

Non Custodial Cryptowallet & Cold Mobile Crypto Wallet

In the ever-evolving world of

Ironwallet: Guide to Non-Custodial Wallets

Greetings, fellow technology enthusiasts! Cryptocurrency

Current Story

Noblewood Group Offers New Prospects for the Montenegrin Economy

Until 2022, the Montenegrin economy

America Granted Work Permits For Indian Spouses of H-1 B Visa Holders

On 26 February 2015, the

Business

-

Benefits of Large Portable Storage Containers in Melbourne

Due to their simplicity and adaptability, portable storage containers have grown in popularity in Melbourne. There are many advantages to using these huge containers for homes and companies. In this article, we will explore what a portable storage container is and delve into the advantages of using a large-sized container

-

Follow These Steps And Choose A Reliable International Shipping Company

Are you an international shipper who needs to find a reliable and cost-effective shipping option? Or, maybe you’re a business owner launching an e-commerce business that requires global customers. No matter what your company does globally, proper international shipping is essential for success. And in order to get the best

-

Tips for Protecting Your Vehicle Against Theft

The theft of motor vehicles is a significant problem that impacts the lives of thousands of car owners each year. Not only is it a financial burden, but it can also be a major inconvenience and a source of stress. It may also disrupt your daily routine and cause emotional

-

How to do Dropshipping Business

Dropshipping is a business model in which a retailer (you) does not keep goods in stock but instead transfers customer orders and shipment details to either the manufacturer, another retailer, or a wholesaler, who then ships the goods directly to the customer. As a dropshipper, you are essentially acting as

Tech

-

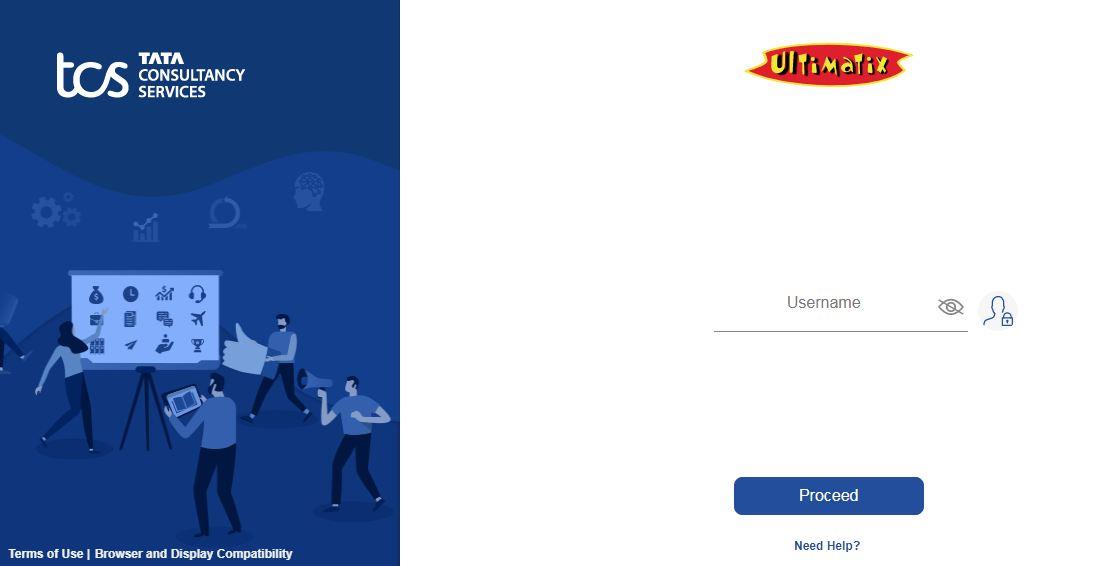

Understanding Ultimatix: An In-Depth Overview

In the dynamic landscape of corporate operations, efficient employee management systems play a pivotal role. Tata Consultancy Services (TCS), a global IT powerhouse, has embraced technological innovation through its proprietary platform, Ultimatix. This article delves into the intricacies of Ultimatix, exploring its features, impact on human resource functions, security measures,

-

12 Important Components of Multimedia Storytelling in the Digital Age

Multimedia storytelling is an important part of communication in the digital age. By combining different types of media, multimedia storytelling can create powerful and engaging stories, allowing people to experience them more meaningfully. It provides a platform to share stories with a larger audience and can be used in various

-

How to set up an ODC in 2023?

Offshore Development Center (ODC) is a business model that enables companies to establish their development center in another country. It provides access to skilled IT professionals, cost-effective solutions, and a strategic location for businesses looking to expand their operations. With the increasing demand for technological advancements, many companies are exploring

-

7 Reasons Why You should use a VPN for Your Smartphone in Canada

VPN (or Virtual Private Network) may sound like an advanced and technological thing for ordinary users to have. If you don’t know about VPNs, perhaps, now is the time you do because it is a wonderful idea put into practice to ensure the security of the users, ordinary or not.

Health

Characteristics of a Successful Psychiatric Mental Health Nurse Practitioner

As more people are starting

Sports

Al Nassr: A Deep Dive into the Saudi Football Powerhouse

As one of the most prominent football clubs in

Unveiling the Dynamics: JJ Watt’s Candid Conversation on The Pat McAfee Show

Introduction In the ever-evolving landscape of sports and entertainment

Marketing

Dmitry Gordovich — Supervisor of Charity Programs at BBR Bank

Patronage and charity have been traditionally well-developed in the banking

12 Important Leadership Skills for a more Productive Workplace

Leadership skills are essential for creating a productive and engaged

Real Estate

Restrictive Covenants and Homeowners’ Associations: A Guide for Homeowners

Whether you are a new homeowner navigating the world of

10 Incredible Grayhawk Condos for Sale That You Must See

Are you in the market for a new home? Have

Travel

Unveiling the Ultimate Riviera Maya Adventure: Top Activities to Explorein Riviera Maya

Introduction to Riviera Maya Nestled

Checking Out the Most Historical Cities of South Carolina

South Carolina is bursting with

8 Surprising Things That Might Be Illegal in Florida

Florida is known as one

Entertainment

FuboTV: The Comprehensive Guide

FuboTV, a leading player in the streaming industry, has carved